Semiconductors’ situation in Europe – from plans to possibilities

European industrial autonomy in semiconductors is still a long to go. The current semiconductor shortfall has exposed one of Europe’s weaknesses, forcing the European Commission to establish objectives for the area to account for 20% of global semiconductor manufacturing by 2030. It also intends to increase chip output by utilizing the most modern manufacturing technology (5nm node and below). To increase its share of global chip output from 6% to 20%, Europe would need to invest considerably more than the whole industry. Chinese, Taiwanese and South Korean players on the other hand, are significantly outperforming their European counterparts in this respect. Furthermore, looking beyond 2030, Europe would need to create comparable semiconductor demands since proximity to production is important. Europe’s chip demand is primarily driven by the automotive and industrial industries, which account for around 20% of worldwide semiconductor sales. Over the last 15 years, the region’s semiconductor bill has stayed largely constant, while worldwide chip demand has more than quadrupled. The lack of local demand further complicates the goal of having local state-of-the-art chip-making capacity. Europe should play the long game, putting its chips where they will be most effective. Support may be directed to areas where the requirements are most severe and well-documented, such as manufacturing capacity supporting the European automotive and industrial sectors. A stronger ecosystem in critical future semiconductor technologies with numerous applications across European industries, such as artificial intelligence and quantum computing in the distant future, would undoubtedly reduce Europe’s future reliance on foreign components and technologies, resulting in a naturally broader semiconductor manufacturing footprint. Chips used in automobiles and industrial machinery rely on most well-established manufacturing technologies, they are not as much profitable as the computing, memory, and communications chips used in average smartphones.

Europe is an integral part of semiconductor manufacturing. This region accounts for about 6% of the world’s production capacity across all manufacturing technologies. In particular, the region is the main design for automotive and industrial chips and is home to manufacturers Infineon, NXP and ST Micro. Europe is virtually incapable of producing <22nm node chips, which was first introduced 10 years ago, as the locally produced mix fits the local demand mix. Compared to China, which is striving to expand its presence in the semiconductor industry, Europe’s position looks very loose, but it generally conforms to its needs.

Chart: Manufacturing capacities share: Europe vs China

Sources: IC Insights, Dec 2020 data, 200mm equivalent wafers

Europe’s increase from 6% to 20% of the world’s chip production would require much more investment than the entire industry, whether in value or quantity. To control 20% of the global chip output, that should correspond with appropriate needs. Most of the chips produced in the world are responding to the needs of the region’s because the proximity between chipmakers and chip designers and/or chipmakers and client industries is important to the industry. European chip needs stem primarily from the automotive and industrial sectors, which together account for about 20% of global chip sales. Europe is substantially short of the industries that generate the remaining 80% of the world’s chip sales, such as smartphones, computers, servers, audio and video devices.

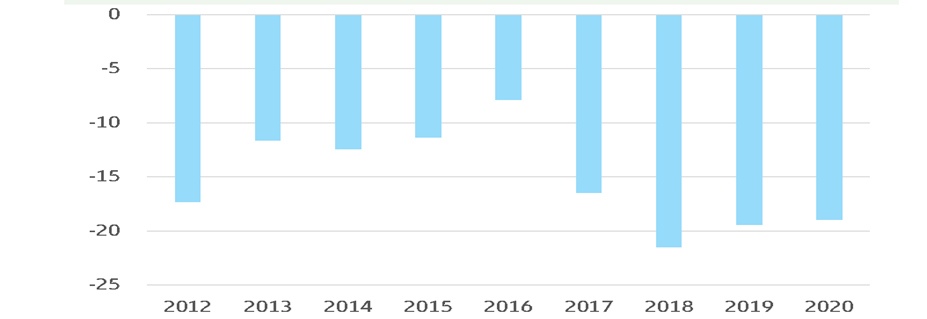

No European manufacturer has the financial possibilities or required technology to build a large – scale foundry to build 5 Nm chips. Intel’s new CEO estimated the cost of building a new foundry in Europe at EUR8BN. Industrial policy for semiconductors would get positive results by focusing on urgent matters. Europe has a structural deficit for semiconductors, in accordance with previous observations on local semiconductor needs. It is only about 2% of Europe’s imports, but this deficit may leave the local industries vulnerable to shortages.

Chart: Semiconductors – Europe’s trade balance deficit (bn USD)

Sources: Intracen, RCieSolution Research

Countries and firms in the semiconductor sector have developed their competitive advantages through decades of investment in R&D and production facilities. No country can claim total control of the semiconductor value chain, and even the world’s leading semiconductor businesses usually dominate a small sector when seen as a whole (silicon material, semiconductor manufacturing, chip manufacturing and design). Europe may concentrate on areas where chip content is increasing and where it still plays a significant role in global competitiveness. This is especially true in the automobile, healthcare, and industrial machinery industries. Artificial intelligence (AI) has just recently begun to take off across applications and has the potential to find customers in nearly every sector.

Rafal Ciepielski

CEO RCieSolution

Visit social profiles: